Between 8 and 22 July, the “Alpha Research” agency conducted the third consecutive survey as part of the overall monitoring of public attitudes regarding our country’s accession to the euro area. The commissioning body was the Ministry of Finance. A total of 1,200 citizens aged over 16 were interviewed in their homes through direct standardised tablet-based interviews. In addition, 500 business owners or senior managers responsible for company development decisions were surveyed.

Key findings of the survey

Attitudes: stabilisation of support for joining the euro area; decisive importance of the first six months

The nationally representative survey records a stabilisation of support for Bulgaria’s accession to the euro area. Among citizens, the ratio is 49.2% in favour versus 45.8% against (an increase of 3 percentage points compared with May), while business maintains consistently high positive attitudes (69% versus 30%). The overall assessment from both target groups is that if Bulgaria adopts the euro on 1 January 2026, it will be a success for the country in its overall European integration. This view is shared by 43% of the general public and 62% of business representatives.

The main concerns among Bulgarian citizens remain focused on the short-term effects immediately after – and now even before – the introduction of the euro. Although some concerns have eased over the past month, the assessment of near-term consequences remains negative (47% negative opinions versus 39% positive). Regarding long-term effects, both citizens and businesses have optimistic expectations, with entrepreneurs expressing these particularly strongly (65% positive versus 22% negative).

In terms of specific expected benefits, pragmatic and rational views dominate – convenience when travelling and making payments abroad (59%), easier trade with other European countries, increased financial security and stability of the country, strengthening of European belonging and preventing a shift into another sphere of influence (all between 25–30%). These more rational assessments, free from over-expectations and populism, are largely due to the social profile of euro supporters – people with higher education, employed in modern industries, professionals, residents of large cities, and those well-informed about real economic processes.

The most alarming trend identified by the survey is the significant increase in the proportion of people fearing speculation and artificially inflated prices – now at 71%, which is considerably higher than the share of those opposed to the euro. In other words, this concern has spread across wide social groups. In this light, there is a risk of erosion of public attitudes if prices rise towards the end of the year and in the first six months of the next.

Practices: specifics among citizens and businesses

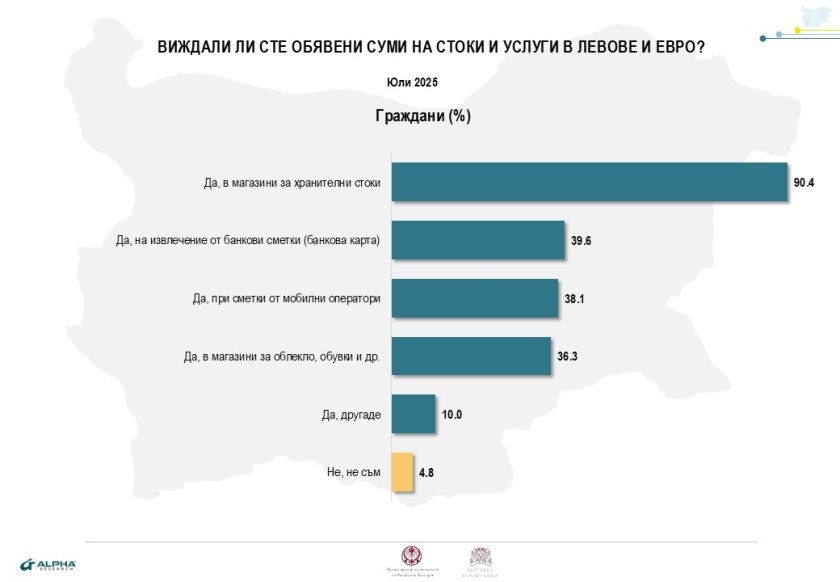

Although dual display of prices in lev and euro was introduced widely only recently, the majority of Bulgarians have already encountered it. Ninety per cent have seen dual prices in grocery stores, 38–40% in bank account statements and mobile operator bills, and 36% in clothing and footwear shops. These first encounters naturally provoke mixed evaluations, as getting used to the new currency takes time. In this sense, the early start of dual pricing is important. At present, people’s self-assessments are almost evenly split – 34% say it helps them and they are beginning to get used to it, while 36% admit it tends to confuse them, most often because they are misled by the lower price shown in euro.

For both citizens and businesses, the preferred way to exchange lev holdings is at bank branches. The share of citizens choosing this method has risen to 71%, almost matching that of businesses (76%). Clearly, banks’ campaigns to accept lev deposits without fees have had an effect. Post offices are mentioned by about 6% of respondents, mainly those living in small settlements. A significant decline is observed in currency exchange offices (from 12% in May to 5% in July), although for people with higher holdings (including some businesses) they remain the second most preferred option.

Business practices: potential impact on the overall economic environment

In this third wave of the survey, a number of new questions were included concerning payment methods used by businesses, anticipated changes in labour costs, and other factors that could influence the country’s economic and financial indicators.

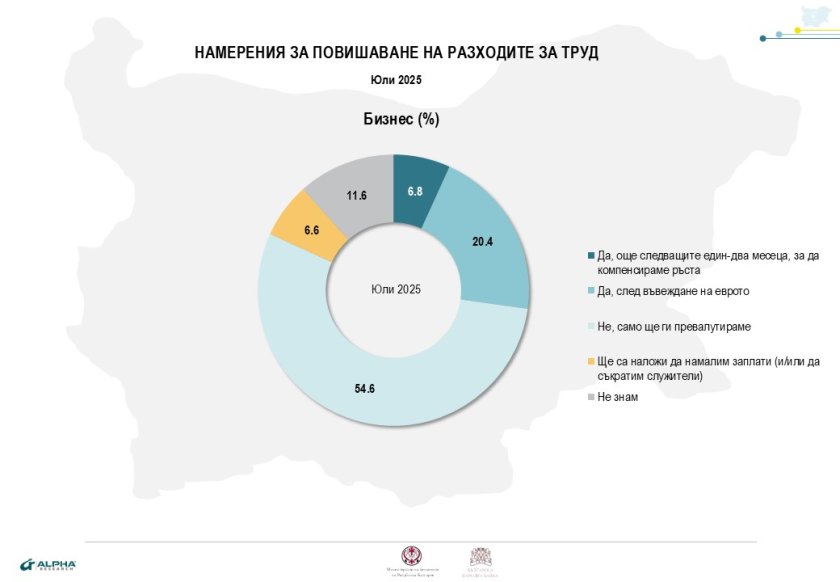

Attitudes to rising labour costs:

In total, over a quarter of company executives believe they will have to increase employee pay in the coming months or immediately after the euro is introduced: 7% foresee this happening within the next one to two months, and a further 20% immediately after adoption. If realised, these expectations could also affect prices and inflation.

Payment methods with employees and suppliers

Asked to estimate the proportion of company payments to employees made via bank transfer versus in cash, firms naturally gave varying ratios, but the overall average result is: 68.5% via bank transfer and 31.5% in cash. Considering that in such surveys responses tend to shift towards the “socially desirable”, the declared 32% in cash payments is not negligible – it will influence both the sums to be converted and potential inflationary pressure on the market. For payments to suppliers, the ratio is more favourable – 77% via bank transfer and 23% in cash. Again, the latter remains significant, especially given the larger sums involved.

Business assessments – readiness of institutions to manage euro introduction preparations

Business assessments of the ability of Bulgarian state and private institutions to handle preparations for introducing the euro are a positive exception to the country’s ongoing institutional trust crisis:

Awareness: positive changes and new challenges

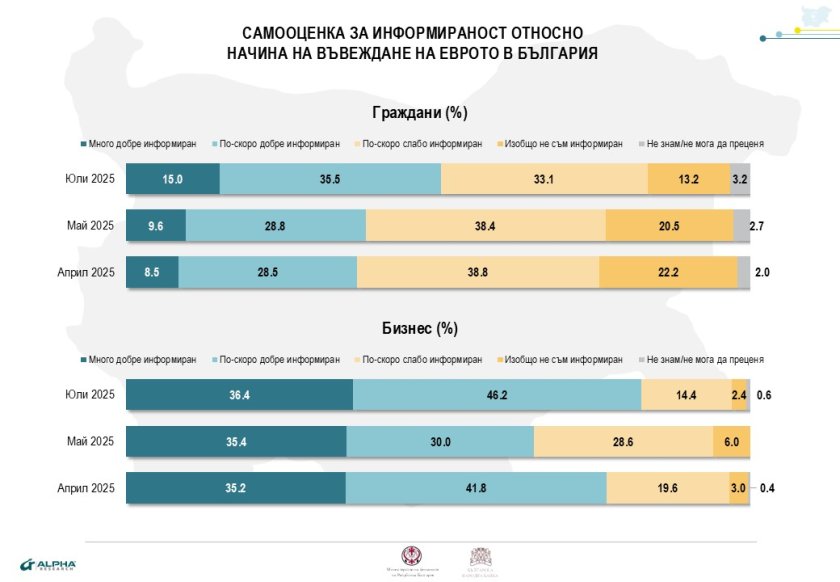

Self-assessment – The survey records a sharp rise in citizens’ self-assessed awareness about the euro introduction – from 39% in May to 50.5% in July. Those informed now outnumber the uninformed (50.5% versus 46.3%). Among entrepreneurs, awareness and active information-seeking remain significantly higher (82.6%).

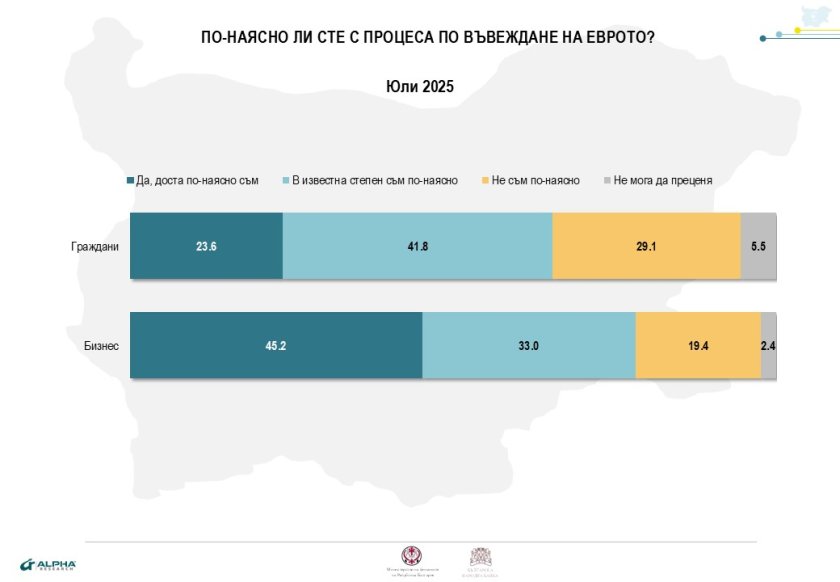

Clarity of the process – The July survey also included an indicator for the usefulness of the information acquired. 23.6% of citizens and 45% of businesses say they are now much clearer about the euro introduction process; 41.8% of citizens and 33% of businesses say they are somewhat clearer. Between 21% and 29% of the respondents admit that they are still not well oriented.

A success of the campaign so far is that it has reached the mass consumer and the middle class. A key task in the coming months is to find appropriate channels, language, and approach to reach vulnerable groups and those not actively seeking information – the elderly, people with low education, residents of remote areas, and students aged 16–18, who generally have little interest in politics and have stayed outside the process.

The main channels through which the information campaign has reached citizens are: television (72%), online news sites (30%), social networks (21%), and brochures/leaflets (7%). Only 18% have not encountered any information about the euro.

What we already know and what we still do not know about the steps to euro adoption

Given the progress of the information campaign and the approaching euro adoption date, Alpha Research included several basic “test” questions in the current survey to establish citizens’ real knowledge on directly relevant practical issues:

Period of dual circulation of lev and euro – This is the question with the weakest awareness: only 19% of citizens and 32.8% of businesses know that it will last exactly one month. Twice as many (37–38% in both groups) believe it will last six months. 17% give other periods, and one in four citizens do not know. Here, a more active and clear campaign is definitely needed.

Economy Minister Orders On-Site Checks at Electricity Suppliers Following Surge in Complaints

Economy Minister Orders On-Site Checks at Electricity Suppliers Following Surge in Complaints

Sunken Fishing Vessel off Sozopol Shows No Breaches or Holes in the Hull, Navy Chief Says

Sunken Fishing Vessel off Sozopol Shows No Breaches or Holes in the Hull, Navy Chief Says

Депутатите отложиха въвеждането на мултифондовете в пенсионната система

Депутатите отложиха въвеждането на мултифондовете в пенсионната система

Казусът с българския европрокурор: Какви са обвиненията срещу Теодора Георгиева?

Казусът с българския европрокурор: Какви са обвиненията срещу Теодора Георгиева?

България не е усвоила нито едно от 600 000 000 евро от фонда за справедлив преход, заяви служебният регионален министър

България не е усвоила нито едно от 600 000 000 евро от фонда за справедлив преход, заяви служебният регионален министър